Javier Milei, the outsider libertarian candidate with radical solutions to Argentina’s economic crisis, has just won Sunday’s presidential runoff against Economy Minister Sergio Massa.

In a surprise outcome, Massa conceded in a speech to supporters in Buenos Aires on Sunday even before the official results were released, saying he called Milei to congratulate him on his victory. The initial results, which were released moments after Massa’s concession, show why Milei was the winner: with 87% of the vote counter, Milei led Massa 56-44%.

Milei, who two months ago was interviewed by Tucker Carlson, has promised to fix Argentina’s perennial economic problems by making drastic budget cuts, replacing the battered peso with the US dollar and shutting down the central bank.

Ep. 24 Argentina’s next president could be Javier Milei. Who is he? We traveled to Buenos Aires to speak with him and find out. pic.twitter.com/4WwTZYoWHs

— Tucker Carlson (@TuckerCarlson) September 14, 2023

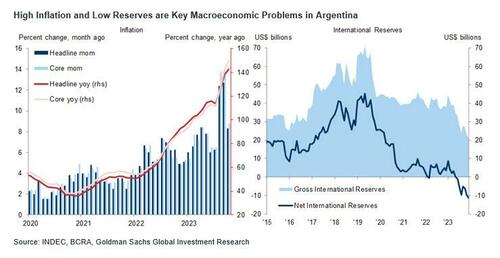

Massa, from the ruling Peronist coalition, placed first in October’s first round, a remarkable comeback after losing a primary election two months previously. But the dire state of Argentina’s economy, plagued by 143% hyperinflation and a looming recession, posed a challenge too far to his presidential bid.

Earlier:

Argentinians return to the polls on Sunday, November 19 to elect the next president in a consequential runoff election. Voters will choose between incumbent Finance Minister Sergio Massa and right-wing libertarian Javier Milei. The election results will shape Argentina’s social and macroeconomic outlook in coming years.

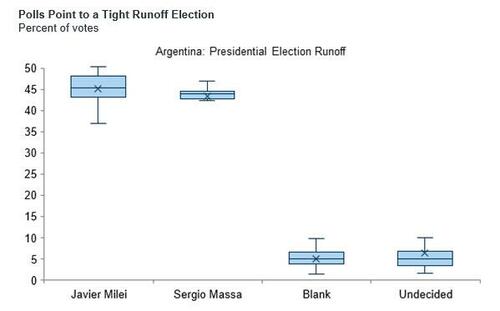

As Goldman writes in its election preview note, polls point to a tightly contested race, with a majority showing Milei having a slight edge in voter preferences. A significant fraction (around one third of polls), however, suggests that Massa is in the lead. In general, polls in Argentina have a poor track record and in this electoral process they have systematically failed to capture shifts in voters’ sentiment. To add to the uncertainty, Massa was seen as outperforming Milei in the final presidential debate last week.

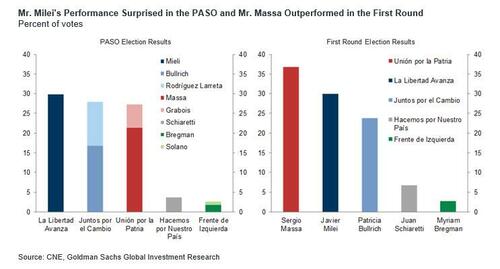

In the August primary elections (PASO), Javier Milei’s La Libertad Avanza party surprised by taking the lead, followed by the center-right coalition Juntos por el Cambio whose presidential ticket would be led by Patricia Bullrich. Massa’s left-leaning Peronist coalition, Unión por la Patria, finished third. In the October first round election, in turn, Massa topped most expectations with an improved performance and finished first. Milei came in second place without a significant change in support, and Bullrich disappointed and finished a distant third.

After the first-round election, part of the Juntos por el Cambio coalition, the faction led by Ms. Bullrich and former President Mauricio Macri, announced their support for Mr. Milei. While the bloc represented by the RadicalPartydecided not to formally endorse any of the candidates, some members have publicly sided with Mr. Massa.

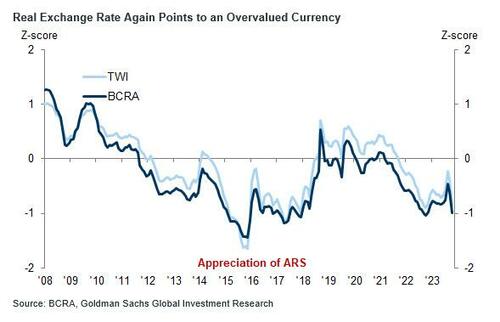

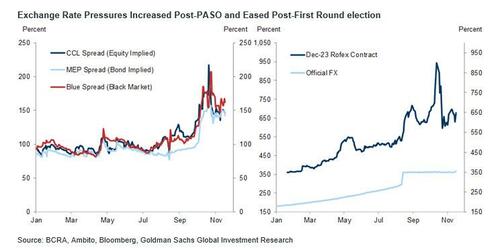

Following Sunday´s results, investors will turn their attention to economic policy announcements. In the short term, the highly managed exchange rate will be a critical variable to follow. After the August primary elections, the government weakened the exchange rate by about 22% to 350 ARS per Dollar. Subsequently, the exchange rate was kept frozen at this level until this week, when a crawl resumed (1.0% so far this week). Nevertheless, pass-through was high and inflation accelerated considerably after the post-PASO devaluation and as a result, the real exchange rate is now even more overvalued than before the August devaluation.

Parallel exchange rates, for their part, continue to trade at a significant spread over the official rate (162% for the informal market exchange rate and around 145% for the bond (MEP) and equity (CCL) implied rates) and the futures market anticipates a meaningful depreciation in the months ahead. Pressures in both markets, however, eased after the first-round election showed Massa first, having increased significantly following Milei’s outperformance in the August PASO.

Likewise important, in the coming months there are significant payments scheduled to the IMF (around US$0.9bn in December and US$1.9bn in January) and foreign currency bond holders (approximately US$1.5bn due in interest payments in January). In the meantime, the EFF program with the IMF remains off track, and in our view its realignment will take time.

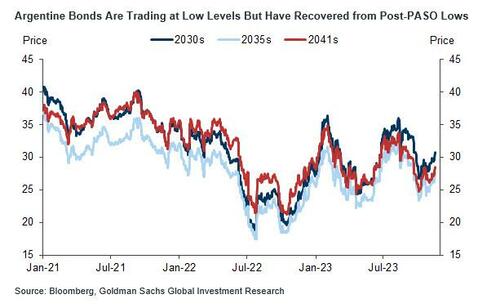

Regardless of the election winner, Goldman writes that a swift change in economic policies is imperative. The accumulated imbalances in the economy have grown too large and must be addressed promptly. The bank expects the economy to contract for the second year in a row in 2024, annual inflation is tracking at close to 150% and is expected to continue to rise in the coming months, the exchange rate is overvalued, international reserves are at critical levels, net reserves are significantly negative (around -US11bn), the fiscal imbalance persists, sovereign bonds trade at distressed levels, and the government lacks access to international financial markets. All in, if policymakers do not steer macro policy in a more orthodox direction, the macro adjustment could impose itself sooner or later, bringing a loss of control of the process and even higher social and economic costs.